New home construction is key to unlocking lower home prices. But the rate of this type of construction has fallen month-over-month since March 2022, and experts say tough immigration policies that have shrunk the construction workforce are behind the decline in construction.

Nationally, foreign-born people make up 30% of construction workers, Census Bureau data show, making immigrants a key part of the homebuilding puzzle. But against a backdrop of tougher immigration policies instituted during the Trump administration and exacerbated during the pandemic, the number of foreign workers entering the construction industry has nearly halved. There were more than 67,000 new workers in 2016, compared to 38,900 in 2020.

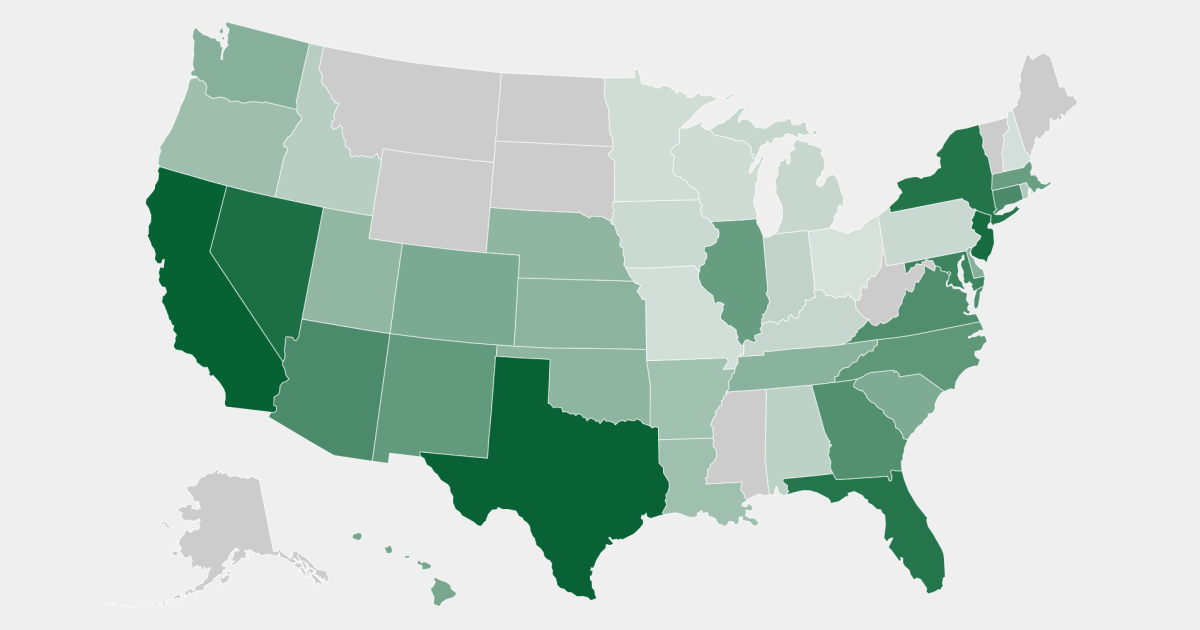

The lack of immigrant workers has led to a shortage in construction, even as stoppages in the supply chain and material costs have eased. NBC News compared Census Bureau data on the population of immigrant construction workers in each state with a 2022 report on housing underproduction from the affordable housing nonprofit Up for Growth and found a strong relationship. between the foreign workforce and slower home construction. Specifically, for each additional 1% increase in the share of immigrant workers, there was a corresponding expected 6,563 increase in the gap between housing units built and demand for units.

“I can’t tell you how many times our members have said, ‘We’d bid for more work, we’d be doing more projects if we had more people to do the construction,’” said Brian Turmail, vice president of public services. matters of the Associated General Contractors of America, which represents homebuilders across the country.

While immigrants are employed in many sectors, certain fields rely more on immigrant labor. This means that stricter immigration policies have a huge effect in certain areas.

Reducing immigration was a political goal of the Trump White House, and the administration issued several policies toward that goal from 2017 through 2021, including visa freezes. The administration has also taken several tough stances toward undocumented immigrants, issuing executive orders for a wall along the southern border, deploying additional Border Patrol agents, and instituting the Migrant Protection Protocols, which required asylum seekers to remain in Mexico while awaiting the hearings.

The number of new immigrant workers entering the construction industry fell by a third in 2017, Donald Trump’s first year in office, the first such decline in six years. And more than 2 million fewer immigrants than expected entered the workforce from March 2020 through the end of 2021, according to estimates by researchers Giovanni Peri and Reem Zaiour of the University of California, Davis.

Many builders said the job tension that began in 2017 has persisted.

“As I sit here, there are two projects that are stalled yesterday and today because there aren’t enough [workers] for crews to send guys there,” said Joshua Correa, a Dallas homebuilder. “Since it was a long time ago, we didn’t have to wait: you’d call and they’d say, ‘We’ll be there tomorrow.’ Now it’s a month or six weeks.»

If foreign-born workers aren’t available, experts say there aren’t enough US-born workers to fill the void.

«These [immigrant] workers are not replaceable,” said Michael Clemens, an economics professor at George Mason University. Clemens has studied the effect of immigrant labor on the labor force and his findings refute the argument that immigrants take jobs that would otherwise be filled by US-born workers. Instead, Clemens found no decline in hiring comparable US workersand, on average, companies that cannot access low-skilled immigrant labor cut profits by 17%.

“Even when employers find some [U.S.-born workers] to fill these positions, they find that there is extremely high turnover in them,” Clemens said.

Immigrants, Clemens said, offer the kind of job opening construction employers need to plan for business in the medium to long term.

For consumers, that shortage of workers means higher prices. House prices, though slightly below their summer 2022 highs, are still above pre-pandemic levels. And with the housing inventory in March 2023 hanging around 560,000 units available: about half of pre-pandemic numbers — experts do not expect any immediate improvement.

“I had to raise prices by $75,000 on all of our standard construction,” Correa said, citing the need to compete with neighboring companies for workers. «If nothing changes, this will only get worse.»