Federal student loan borrowers are facing a reckoning as a result of the tentative debt ceiling agreement reached in Washington.

If the agreement between the Biden administration and top Republicans in Congress becomes law, payments on federal student loans that were halted at the start of the pandemic will be reinstated at the end of August, with those bills due the following month. .

That means some 43 million borrowers like Daniel Galván, a 34-year-old man from Southern California, must start adjusting their household budgets amid higher food costs and other unforeseen expenses.

Galván, a university administrator who still owes about $10,500 on his student loans, said payments may have stopped in the last three years, but his financial obligations have only increased.

Follow live updates

«The pause was useful,» he said Tuesday. «My wife and I could buy a house in 2020. The money that would have gone toward a loan payment helped me save for that house and our start-up expenses. Now, we have 1-year-old twins and they aren’t cheap.»

In March 2020, then-President Donald Trump signed the CARES Act, which allowed federal student loan holders to waive payments without penalty. President Joe Biden extended the pause as concerns about inflation and rising gasoline prices continued to undermine consumers.

Interest on federal student loans has also been waived for the benefit of borrowers. However, the moratorium did not apply to borrowers with privately owned loans.

Natalia Abrams, founder of the Student Debt Crisis Center, a Los Angeles-based nonprofit advocacy group, criticized the White House for allowing student loan relief to roll back, particularly as the administration’s biggest plan Biden to forgive billions of dollars in student loan debt remains in limbo at the Supreme Court.

«The borrowers sold out,» Abrams said. «They feel thrown under the bus with these negotiations.»

His concern, he said, is the possibility that millions of people will be overwhelmed with bills they didn’t know were due and can’t pay. That would be true for borrowers who graduated in 2020 and haven’t had to factor in loan payments in the past three years, she said.

«It really sounds like that could punish young people,» added Rep. Ro Khanna, D-Calif., a member of the House progressive caucus. “And, in my opinion, it would be politically disastrous to force millions of young people to start paying off their student loans when Trump has forgiven them, more or less.”

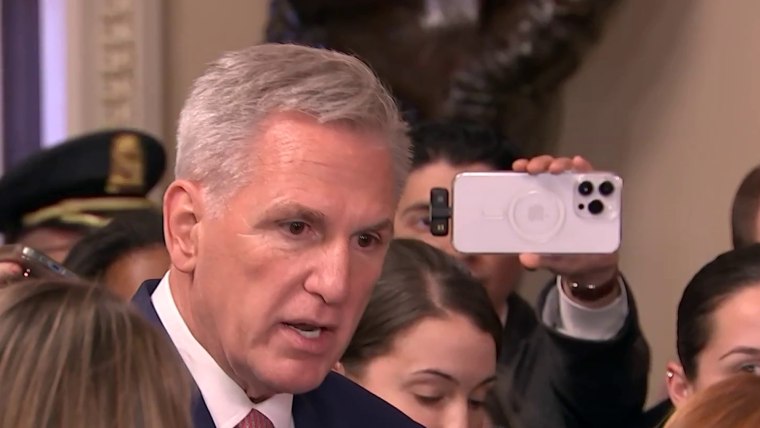

Republicans have been staunchly against continuing the student loan pause, which House Speaker Kevin McCarthy, R-Calif., said has cost taxpayers about $5 billion each month.

«What the president did was unconstitutional and he said he was going to forgive certain people some of their student loan debt, but then he stopped everyone’s student loans,» McCarthy. saying Biden’s in «Fox News Sunday.« He added: «So everyone who took out a student loan within 60 days of signing will have to pay it back.»

Cody Hounanian, executive director of the Student Debt Crisis Center, said he is concerned that the Department of Education is not positioned to take on the «monumental task» of informing student borrowers that they must repay their loans. He added that student loan servicers, some of whom have been accused of predatory lending and deceptive practices, cannot be trusted to have the best interests of borrowers in mind.

“The lives of 40 million people will be affected, while at the end of the day, the cost is a drop in the bucket for the federal government,” Hounanian said. «On the other hand, it’s going to be incredibly damaging to a lot of people’s lives.»

But Education Secretary Miguel Cardona has said his agency is ready to deal with the fallout after warning this spring that student loans could eventually come due as the Supreme Court weighed litigation related to student debt relief.

In a tweet on Sunday, Cardona promised a «smooth return to the payment process,» while ensuring that the debt ceiling agreement «protects our ability to pause student loan payments» during future emergencies.

Biden’s overall plan to forgive federal student debt is estimated to cost more than $400 billion.

The administration has proposed paying off up to $10,000 in debt for those who make less than $125,000 a year or couples who file taxes together and make less than $250,000 a year. Pell Grant recipients, who are the majority of borrowers, would be eligible for an additional $10,000 in debt relief.

Under the plan, about 20 million people could wipe out all of their remaining student loan debt.

But six Republican-led states — Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina — have launched a lawsuit accusing the federal government of exceeding its authority in trying to forgive student debt.

Legal experts say states may feel emboldened, given the high court’s 6-3 conservative majority. During oral arguments in February, conservative justices were skeptical of the administration’s plan, fueling concern among student advocacy groups and Democrats that Biden’s goal of providing student debt relief, that could haunt him as he seeks re-election in 2024, he could be thwarted. .

A Supreme Court decision is expected before the end of June.