WASHINGTON — The Supreme Court heard arguments this week about the Biden administration’s plan to provide student debt relief and questioned the survival of a proposal that has far-reaching impacts.

The executive action, which the administration announced in August ahead of the fall 2022 election (in part to encourage younger voters), could relieve the debt of tens of millions of Americans and cost more than $400 billion.

But judging by this week’s court session, there is a very real possibility that the justices will reject the proposal later this year when they present their opinion.

And if that happens, there will be plenty of disgruntled voters across the country in 2024, including some in major battleground states.

In recent decades, student debt has skyrocketed as a problem for many college-goers, largely because college costs continue to rise.

This year, the average tuition and fees for a year at a private four-year college were $39,400, according to the College Board. In 1992, the average cost of private schools was $21,860, adjusted for inflation. That’s an increase of just over 80% in that time.

At an average four-year public university, the annual cost of tuition and fees was $10,940 this year, according to the College Board. That compares to $4,870 in 1992 (again, adjusted for inflation). That’s an increase of about 125% in that time.

And remember, those figures don’t include room and board, which typically add more than $10,000 to that price. In other words, the days of “working college” seem more and more like ancient history to most students.

In total, these costs equate to more than $1.6 trillion in student loan debt in the US economy.

This summer, the Biden administration offered a targeted approach to address at least some of that debt among those who met certain income requirements: individuals earning less than $125,000 or couples earning less than $250,000.

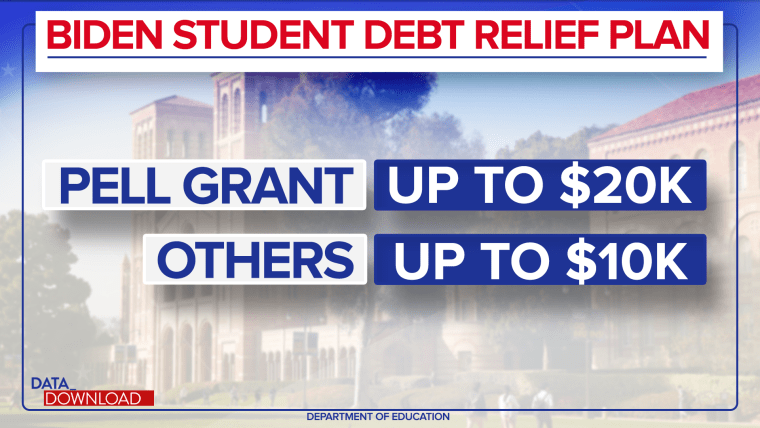

The proposal would have eliminated up to $20,000 of debt among Pell Grant recipients, those who showed “exceptional financial need” when they went to college. It also offered up to $10,000 in debt relief to students who didn’t receive Pell Grants.

At issue in court is whether such a plan could only be implemented by an act of Congress and whether the administration exceeded its authority with the proposal. And the questions posed by the judges certainly suggested that they were skeptical of the plan.

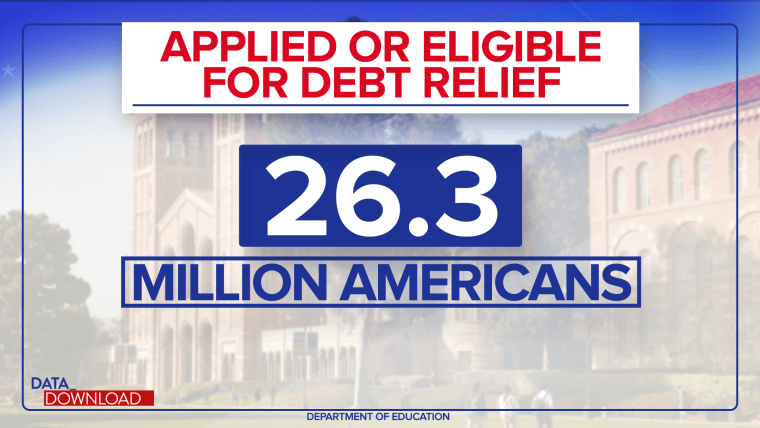

But regardless of what the court decides, the backlash among those affected by student debt was swift and massive. In the four weeks the program was open (before it was frozen due to the Supreme Court case), more than 26 million Americans from all states applied to be a part of it or were told they qualified, according to the administration.

In California and Texas, more than 2 million applied or were notified. More than 1 million applied or were notified in Florida, New York, Pennsylvania, Ohio, Illinois and Georgia. Overall, 43 states had 100,000 or more people who applied for the program or received notification that they qualified for it.

Those are big numbers for just four weeks, a sign of real interest and impact among people saddled with student debt.

And considering the trend of close elections in recent years, all that interest can carry a lot of weight.

The current trend in American politics is one of close elections and a sharply divided electorate. A few thousand votes this way or that can change the balance of power. And if you look at the closest states in the 2020 presidential race, you’ll see a lot of overlap with student debt program applications.

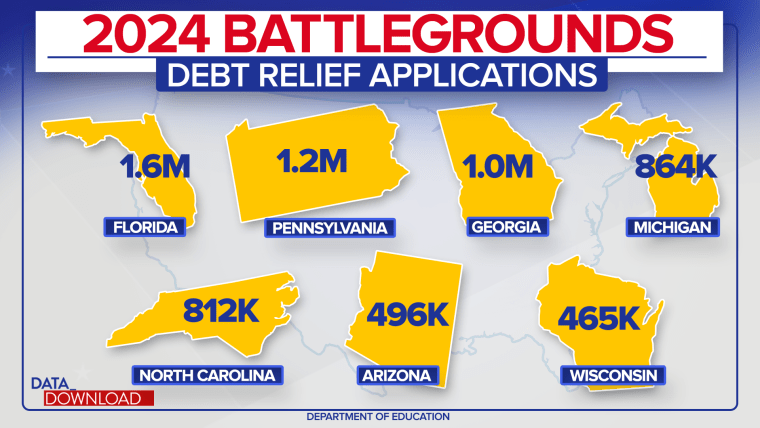

There were eight states where the 2020 election between President Joe Biden and Donald Trump was decided by less than 4 points. Seven of them saw more than 400,000 applications for student debt.

Florida (Trump +3.5 points), Pennsylvania (Biden +1.2 points) and Georgia (Biden +.22 points) had more than 1 million applications for the student debt relief program or were notified of qualifying individuals. he.

Michigan (Biden +2.8 points) and North Carolina (Trump +1.3 points) each saw more than 800,000 people in that group. And Arizona (Biden +.3 points) and Wisconsin (Biden +.6 points) had more than 400,000 people.

That’s not to say that student debt is simply a political issue. There are tens of millions of people for whom this problem is very real.

But in reality, the student debt relief plan was partly a political move, a proposal intended to encourage younger voters and get them to vote. And it could have helped the Democrats. Turnout among younger voters rose in battleground states in 2022, and Republicans overall had a lackluster midterm.

How do the 26 million people who benefited from the program in 2024 feel: angry, frustrated, apathetic? In another close election, the answer to that question could carry a lot of weight.